In a very significant recent development, Odisha Electricity Regulatory Commission (OERC) awarded the letter of intent to Tata Power as the successful bidder to own the licence for the distribution and retail supply of electricity in Odisha’s five circles, together constituting Central Electricity Supply Utility of Odisha (CESU).

The five electrical circles constituting CESU are the areas of Bhubaneswar (Electrical Circle – I and II), Cuttack, Paradip and Dhenkanal. The licence is being offered for 25 years initially.

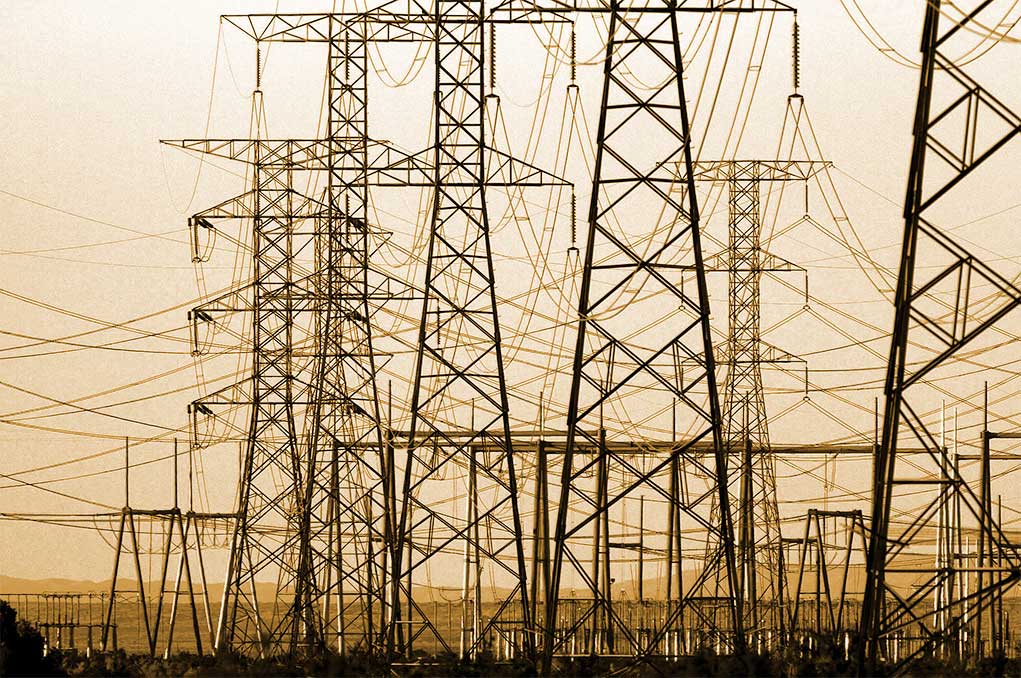

CESU is spread over 30,000 sqkm with a population of over 1.4 crore and a consumer base of 2.5 million. The average demand of CESU is around 1,300 mw with the annual input energy of 8,400 million kwh, as of FY18.

The proposed sale of CESU to Tata Power will be through the formation of a special purpose vehicle. Tata Power has been informed that the Odisha government will own 49 per cent equity stake in the proposed SPV and Tata Power will hold 51 per cent equity along with management control.

For Odisha, this is a landmark development. The eastern state, way back in 1999, was the first to usher in privatization in the power distribution sector. For nearly two decades, the state continued to experiment with various entities but privatization simply did not work out. There was no significant improvement in the power distribution infrastructure, quality of supply, customer satisfaction and many other such indicators. For a state that has such a tumultuous journey, this joint venture, especially with an experienced partner like Tata Power, should mark a phase of resuscitation.

Privatisation of power distribution broadly has two modes – distribution licensee model and distribution franchisee model. The licensee model involves ownership and management of the grid infrastructure, while the franchisee model is asset-light and focuses mainly on billing and revenue collection.

India has experimented with the distribution franchisee model but there is no clear evidence that the model has been successful. The number of failures and successes more or less cancel each other out. There have been cases where the model has worked. The Bhiwandi circle in Maharashtra awarded to Torrent Power in 2007 is an important case in point. This was incidentally, the first countrywide attempt at the distribution franchisee model. Currently, around 12 DFs are operating in the country. Among the experiments that failed, which is to say the mandate was cancelled, include: Ujjain, Sagar and Gwalior (Madhya Pradesh, awarded to Essel Group); Jamshedpur (Jharkhand, Tata Power); Ranchi (Jharkhand, CESC); Kanpur (Uttar Pradesh, Torrent Power), and several others.

It is also interesting to note that while some companies had successful experience in one state, their mandates were cancelled in others. For instance, Torrent Power suffered a cancellation of its mandate in Kanpur even as it did very well in Bhiwandi, Maharashtra. Tata Power, which is perhaps the most successful proponent of the public-private partnership (PPP) model across the entire power value chain, suffered a cancellation of its mandate in Jamshedpur.

If one looks at the nationwide attempt at inducting private sector enterprise in the power T&D value chain, the only outstanding example is that of the erstwhile Delhi Vidyut Board (DVB) being privatized under the licensee model, way back in 2003. Tata Power Delhi Distribution Ltd was formed as a joint venture between Tata Power (equity stake: 51 per cent and management control) and the Government of NCT of Delhi, for north Delhi region. Two similar joint ventures—BSES Yamuna Power and BSES Rajdhani—were also formed with Reliance Infrastructure (equity stake: 51 per cent and management control) as the private partner.

All these three joint ventures have delivered remarkable results, to the extent that they have exceeded even the most liberal expectations. Nowhere else in the country has there been such drastic improvement in the power distribution scenario that Delhi has witnessed through threes three joint ventures.

Also read: JVs appear to be the best route for power distribution privatization

Clearly, the road ahead for public private partnership in power distribution is through the licensing model. The distribution franchisee model does not involve equity partnership from the two parties—private entity and the state government concerned—and is thus an intrinsically weak association between the public and private partner. It is also alleged that private franchisees are not supported enough and have to fend for themselves while dealing with consumers, in sensitive matters like billing and revenue collection.

When there is a joint venture, there is equity commitment from the state government. This creates a stronger bond in the public-private partnership.

The way the newly-formed joint venture with Tata Power performs in Odisha will pave the way for the future role of public-private partnership in India’s beleaguered power distribution sector. This model has been revisited after 15 long years and during these years, there is enough indication that other experiments to shore up technical and commercial efficiency in power distribution through the engagement of private enterprise, have by and large failed.

The author of this article, Venugopal Pillai, is Editor, T&D India, and may be reached on venugopal.pillai@tndindia.com. Views expressed here are personal.