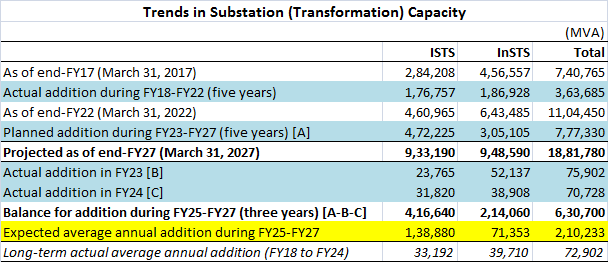

The recently-launched “National Electricity Plan” has envisaged India to have nearly 1,900 GVA of transformation capacity by end of FY27. However, going by the actual performance in recent years, the pace of capacity addition needs significant acceleration, if India has to come anywhere close to the projected level.

The National Electricity Plan – Volume 2 (Transmission), officially released this month, has projected substation capacity addition of 7,77,330 MVA during the five year period ending FY27 (which is April 1, 2022 to March 31, 2027).

This would take India’s transformation capacity to 18,81,780 MVA by March 31, 2027, which would be 70 per cent higher than 11,04,450 MVA, as of March 31, 2022.

Let us take a look at the actual performance. In FY23, a total of 75,902 MVA of substation capacity was added, followed by another 70,728 MVA in FY24.

This means that out of the 7,77,330 MVA expected to be added in the five-year period from FY23 to FY27, actual addition in the first two years has been 1,46,630 MVA. In other words, in the remaining three-year period – from FY25 (current year) to FY27 – a whopping 6,30,700 MVA will need to be added if the targeted addition were to materialize.

This implies that the average substation capacity addition during FY25-FY27 will need to be around 2,10,233 MVA. This appears arduous, at least going by what actual achievement in the recent past has been.

During the seven-year period from FY18 to FY24 (which is April 1, 2017 to March 31, 2024), the average annual substation capacity addition has been 72,902 MVA.

It can thus be seen that this pace of addition in the three-year period from FY25 to FY27, will need to be around three times the long-term average.

ISTS vs InSTS

Of the 7,77,330 MVA that is projected to be added in the five-year period from FY23 to FY27, around 60 per cent will be on the ISTS side, while the remaining 40 per cent will be on the intrastate transmission system (InSTS).

In terms of meeting the overall targeted addition, there is more pressure to perform on the ISTS side. In the next three years (FY25 to FY27), the average capacity addition will need to be in the region of 1,38,880 MVA, which is over four times the long-term average of 33,192 MVA seen over the period FY18 to FY24.

Undoubtedly, the number of ISTS schemes awarded in recent years has reached historic highs. In FY24, a total of 23 ISTS projects were awarded under the tariff-based competitive bidding (TBCB) mode alone. Several others were assigned under the RTM route. In the first half of FY25, a total of 14 ISTS-TBCB schemes were awarded, followed by at least four more schemes in October 2024 so far.

Going by the bidding pipeline, there are at least 40 ISTS-TBCB schemes under different stages of bidding, and which are pending award.

In principle, these schemes pending award, along with those on the RTM route, could cover the envisaged target. The point is that a typical transmission project (conventional AC and not HVDC) takes two years to complete.

ISTS projects must not only be awarded expeditiously but their implementation also needs to be seriously fast-tracked. Only this will ensure that the envisaged transformation capacity base of 1,881 GVA, as of March 31, 2027, is attained with the minimum possible shortfall.

(Important note: This report takes into account substations of 220kV or higher, only)

The author of this article Venugopal Pillai, is Editor, T&D India, and may be reached on venugopal.pillai@tndindia.com. Views are personal.