States must actively draw upon PGCIL’s expertise

One option by which PGCIL could meaningfully engage in intrastate projects is through joint ventures with state power utilities, at least for specific projects.

Very recenty, there was a news report that Kerala State Electricity Board was seeking the involvement of Power Grid Corporation of India (PGCIL) in the southern state’s ambitious “Transgrid-2.0” project. The Rs.10,000-crore project envisages substantial upgrade to its power transmission network, and that too, with a conscious adoption of modern technology.

It is well known that even if almost all the erstwhile state electricity boards have been split into separate entities for generation, transmission and distribution, most of them still lack the technical expertise or the financial prowess to deal with complexities in their intrastate transmission networks. This is exactly why drawing upon PGCIL’s competency could be harnessed advantageously.

Special Cases

In some deserving cases, PGCIL is carrying out intrastate power transmission upgrade, thanks to extreme conditions that the state government-utilities would find difficult to contend with. For instance, PGCIL is implementing a project worth over Rs.5,000 crore to improve transmission network in topographically-challenging northeastern India, touching all northeastern states except Arunachal Pradesh. However, in Arunachal Pradesh and Sikkim alone, PGCIL has been entrusted with a Rs.4,700-crore project to improve transmission and distribution infrastructure. In Jammu & Kashmir also, PGCIL is involved in a Rs.1,800-project to connect the isolated Leh-Kargil area to the northern grid with a 220kV line. In these cases, PGCIL is playing the role of a “consultant” and has received the mandate from the Central government.

The real problem lies with states that are not “special” like the northeastern ones or Jammu & Kashmir, nor at the other extreme, are fully equipped to deal with their power transmission network.

TBCB might not work

State power utilities of course have the option of using the tariff-based competitive bidding mechanism that can bring in enterprise and investment, in a competitive environment. However, not many states of them have pursued this option aggressively although there are honourable exceptions like Haryana, Uttar Pradesh, Rajasthan, Haryana, etc. All said, the extent to which TBCB has percolated into intrastate projects, at the national level, is still shallow. Even if states float projects on the TBCB mechanism, PGCIL is free to bid just as it has successfully done in interregional lines. In such a case, states stand a potential chance to get PGCIL’s involvement. But the point is: Would PGCIL be excited enough to proactively participate in micro-level intrastate projects?

The JV option

One option by which PGCIL could meaningful engage in intrastate projects is through joint ventures with state power utilities, at least for specific projects. It has done so with Bihar, resulting in the formation of Bihar Grid Company Ltd, a 50:50 joint venture. PGCIL was engaged in similar talks with Odisha but the proposal did not take shape, ostensibly due to insufficient propulsion by the state government.

State governments must draw upon the rich technical and managerial experience of PGCIL and actively consider the joint venture route. To start with, JVs could be formed for specific but complex projects. Quite admittedly, formation of joint ventures would involve extended discussions and procedural formalities. The JV with Bihar, for instance, was formed in 2013 and has had its share of teething troubles. But once again, state governments would do well to realize that roping PGCIL has a JV partner is well worth the effort. For PGCIL too, an equity stake would mean closer bonding with the project, perhaps much more than it would in the capacity of a consultant.

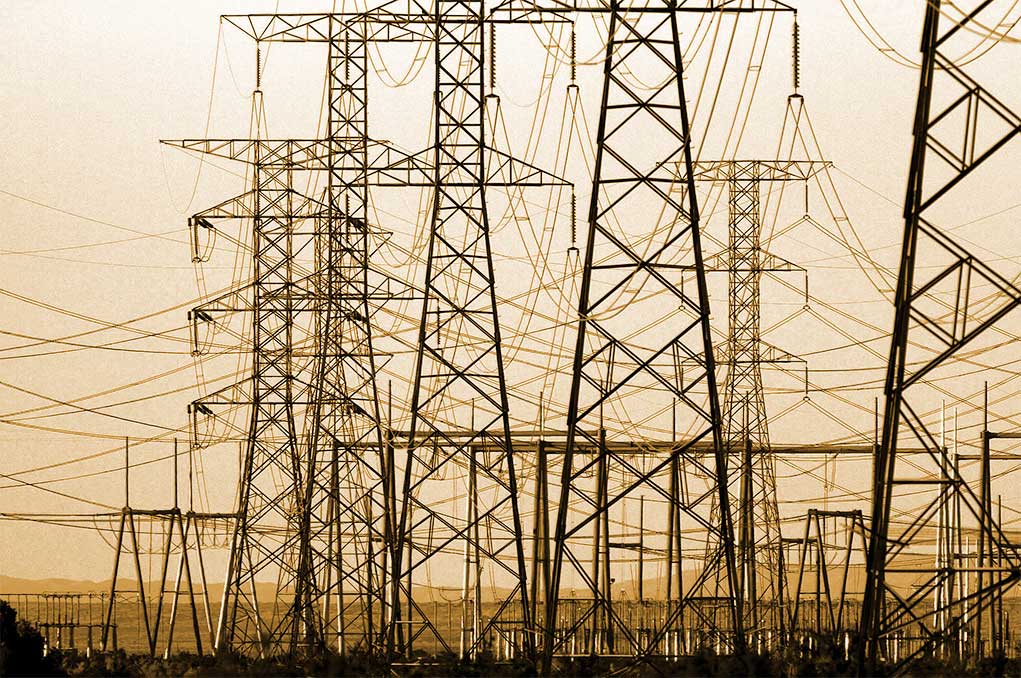

(Photo: RTS Power Corporation)

(This article’s author, Venugopal Pillai, is Editor, T&D India. Views expressed here are personal. The author may be contacted on venugopal.pillai@tndindia.com)